How to Write a Check

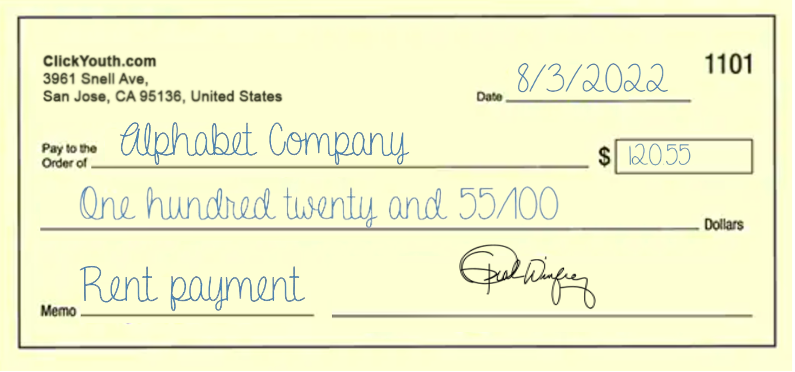

How to write a check? Writing a check is easy. First, fill out the right corner blanks with the date, and put the payee name and amount below. Then write down the memo and put down the signature. After that, it’s a walk in the park.

You must only go through the process if you are trying to write a check for the first time. You might get confused about where to put the signature and how to write the correct amount with cents. If you’ve never filled out a check, there are many things you’ll want to know.

Checks are one of the most popular forms of payment in the world. They are used for different purposes, such as purchasing, paying for services, depositing money, etc. You are supposed to avoid certain common mistakes while writing a check.

Let me explain the process.

How to write a check: Step by Step Guide

Step 1: Put Down Date

Put down the date above the line at the top right-hand corner. It is important to put the date, so the payee will know when you have filled the check.

There are a few valid reasons to put the date on the check. First, it indicates when the check recipient can be deposited or enchased. You are supposed to put the future date on the check depending upon the agreed terms and conditions to whom money is paid or is to be paid.

Step 2: Write Down Payee Name

The next line on the check is “Pay to the order of.” Again, there are two ways to fill this blank.

If you know the Payee (Cross Check): Filling out the payee section is the next step. Payee means “Pay to the order of,” is a person or a company to whom money is to be paid.

If you don’t know or Don’t want to mention the name of the Payee (Open Check): Write down the word “cash” if you don’t know or don’t want to mention the person or company’s exact name.

![]()

The cross-check can only be deposited in the account of the mentioned name. However, the open check can be deposited into any bank account, so writing an open check is more risky and unsafe.

Step 3: Fill out the amount

There are two blank spots on the check where you are supposed to mention the amount in both numbers and words.

A)- Amount in Numbers

First, you’ll have to fill the blank in dollar amount numerically (for example, $120.55) in the small box on the right. Then, please write it down carefully so the bank or ATM can recognize the same amount and subtract it from your account without confusion.

B)- Amount in Words

On the line below “Pay to the order of,” fill out the same dollar amount in words. For example, paying $120.55 will write “one hundred twenty and 55/100.”

![]()

Make sure that always write down cents amounts over 100. If the dollar amount is a round figure, don’t forget to write it as “ and 00/100”. Let me show you a few examples:

Step 4: Memo Writing

Putting down the line that says “Memo” is not mandatory, but it will allow the bank to understand why you are paying this amount.

It is a reason for payment which may be “Monthly rent,” “Family support,” “Business transaction,” or any other reason for which the amount is being transferred.

It is an unofficial note for your record so that you can write the memo in informal terms per your understanding.

Step 5: Put a signature.

At the bottom right-hand corner, you are supposed to put the signature. It is mandatory to put the same signature which you have put in the form while opening a bank account.

FAQs

How to track the transactions

Each time you withdraw cash or deposit the amount, you should keep all these transactions in your checkbook’s check register, which can be found with the checks you got from Bank.

Your check register is intended to be utilized for monitoring your withdrawals and deposits. All exchanges should be recorded, including bills, ATM withdrawals, charge card installments, etc.

How Transactions Work with Checks

When a bank processes a check, it does not actually “pay” the recipient. Instead, the bank credits the recipient’s account with an amount equal to what was written on the check minus any fees the bank charges for processing it.

Then, the bank credits this amount to your account and debits your account for any incurred costs during this process.

How to Cash Checks and Avoid Scams

You should know how to cash your checks to avoid getting scammed.

You must first go to the bank and ask for a cashier’s check. This will ensure that the money goes into your account, not someone else’s. You can also use a bank teller if you are worried about the safety of your checking account.

The best way to avoid scams is by being extra careful about online transactions. Always deal with a reputable seller or service provider before handing in personal information or payment details.

How To Protect Yourself Against Identity Theft and Other Scams When Paying With Checks

The check fraud prevention industry is a booming one. However, with new technologies, such as digital banking and online check deposits, banks find it difficult to prevent fraud.

With these new technologies and the rise in online transactions, banks find it difficult to prevent check fraud. To make sure that your checks are not being forged or stolen, there are five smart ways you can avoid being scammed.

If you are one of the people who often pay with checks, you may want to protect yourself against identity theft and other scams.

#1- Be aware of your bank account balance

#2- Use a check register (keep track of who has cashed your checks)

#3- Keep a record of all checks that you have written

#4- Don’t write your Social Security number on the check

#5- Ask for ID before depositing the check

Related Posts:

1)- How to Fill Out a Money Order

2)- How to Write A Check For 1000

3)- How to Write a Check For 1200 Dollars

4)- How to Write a Check For 1500

5)- Filling Out a Check – Common Mistakes

6)- Bitcoin – Benefits and Costs

7)- Top 10 Affiliate Programs and Platforms

8)- How to Choose a Business Name?

10)- Ten Medicare Myths and Facts